Address:999 Nanhuan West Road, Jiangyan District, Taizhou City, Jiangsu Province

Tel:0523-88151068

E-mail:1907913533@qq.com

Fax:0523-88151068

Website:http://www.jspydl.com

Peng Peng: three major points of photovoltaic Asset Securitization

On the one hand, the photovoltaic installed capacity soared, while the funds are reluctant to admit, the photovoltaic industry into financing difficulties. For the green industry financing difficulties, financing expensive, in September last year, the central bank and other seven ministries jointly issued the "guidance" on the construction of green financial system, the full deployment of Chinese green financial system. With the support of the policy, both financial institutions and photovoltaic power plant developers have begun to explore the field of power plant financing from different angles, and actively explore the financing model suitable for the industry.

Compared with other financing methods, asset securitization has many advantages, such as long financing cycle, low financing cost, and optimization of enterprise assets and liabilities structure, which is favored by most photovoltaic enterprises. Then, in the realization of photovoltaic asset securitization process, what problems need to be solved? In the "2017 photovoltaic power plant operation and maintenance of new ideas, new methods and new technology seminar" China Association of circular economy renewable energy policy research committee director Peng Peng to do a detailed explanation.

First, the current status of photovoltaic stock assets

In 2016, China's total installed capacity of photovoltaic power generation 77.42GW, the annual generating capacity of 66 billion 200 million kwh, accounting for 1% of China's annual total electricity output. According to the average 8 yuan /w calculation, the stock assets of more than 600 billion, is expected in 2017 annual electricity generation cash flow in the case of subsidy arrears can also exceed 50 billion, if the subsidy is not in arrears, more than 100 billion.

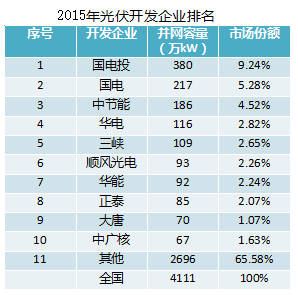

In whose hands are the assets now? According to the water conservancy and hydropower planning and Design Institute published in 2015 and 2016 (data or photovoltaic development enterprises ranked with the most companies slightly different), can be seen in concentrated photovoltaic assets has the following three characteristics:

First, the holding of photovoltaic assets gradually began to focus. As can be seen from the list, the market share of other small and medium-sized enterprises has declined, accounting for 65% of the shares held in 2015, down to 53% in 2016, and the concentration of photovoltaic assets has become increasingly concentrated. This means that the holder must have the ability to match the financial capacity. In addition, with the tightening of the financial market, the test of the ability to hold the financing of the moment, last year, some developers rushed very hard, subsidies this year can not get, plus interest rates rise, pressure will increase.

Second, the proportion of private enterprises still rising. In 2015 the top ten photovoltaic development enterprises, private enterprises less, to 2016, Lee Teng Hui, GCL, crystal, etc. are on the list and hold a large amount of. What can not be ignored is that, for state-owned enterprises, especially the five major power generation groups can get the lowest average financing cost of the whole society, and they may not be interested in the securitization of the plant assets. However, the financing costs of private enterprises are generally higher, and there is a more urgent demand for low-cost financing. Therefore, through the reasonable asset screening standard, the qualified assets and the slightly bad assets distinguish, can let the high-quality assets obtain the lower financing cost.

Third, the power plant transactions brisk, statistical data lag. In 2016, the list of large EPC enterprises, indicating that the power plant trading is still very active. Unlike the previous two years' end transactions, today's power plant transactions have focused on completion. After the completion of the power station, another problem is the judgment of the quality of the power plant, and the selection of the accepted third party or standard. Reducing transparency is also crucial in the future.

Two, the focus of photovoltaic Asset Securitization

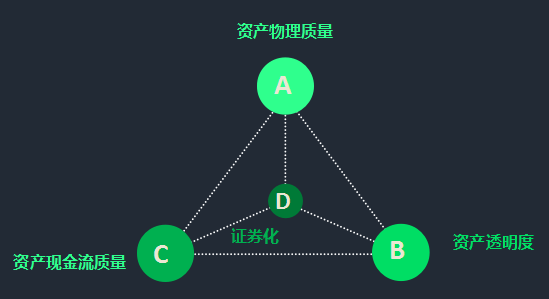

A photovoltaic asset securitization, the focus of attention of investors has three aspects: one is the quality of physical assets, refers to the power plant can be in accordance with the expected power, depending on the use of the equipment and construction quality; two is the asset transparency, need to have the credibility of the organization to do a credit endorsement station data; three is the asset cash flow quality. Depending on the power generating capacity can reach the expected.

In order to realize the asset securitization of photovoltaic power station, the following problems need to be solved:

First, the power plant physical quality mutual trust degree is low. Although the power plant can produce one or two audit reports, banks and other financial institutions may not approve this audit report.

Two, photovoltaic asset valuation methods still need to study. In a completely different case, which method is more reasonable for PV asset valuation? This will be the focus of future research.

Three, centralized ground and distributed cash flow are difficult. Effect of centralized ground station capital flow mainly subsidies in arrears, and for distributed PV projects, although there is no electricity subsidies, the problem of arrears, but due to the project construction in the roof of the owner, the electricity sold to the owners need to obtain tariff revenue, so the roof owners reputation, business risk will affect the stability. The operation period of the project cash flow.

To solve the above problems, we need to study in the process of asset securitization:

First, the primary market is standardized first. Through the National PV data monitoring platform, long period real-time data reports are provided.

Second, reasonable valuations. By combining the physical quality of the power station and the cash flow in its region, the method of valuation is applied to provide reasonable valuations acceptable to both the owner and the investor.

Third, the two tier market asset package. Through reasonable valuation, make more standard asset package into the two market, can be green bonds, or SPV can be used as a special carrier of green ABS products.